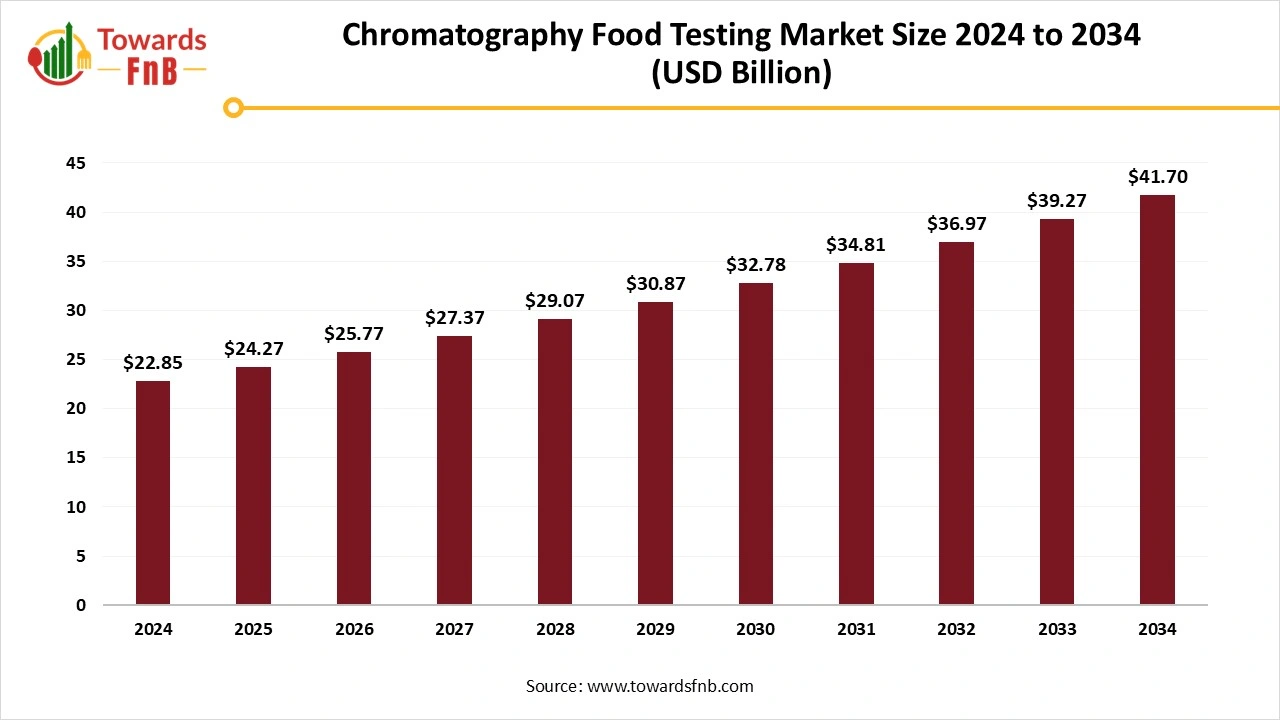

Chromatography Food Testing Market Size to Exceed USD 41.70 Billion by 2034, Driven by Stricter Food Safety Regulations and PFAS Monitoring

According to Towards FnB, the global chromatography food testing market size is calculated at USD 24.27 billion in 2025 and is anticipated to surge USD 41.70 billion by 2034, reflecting at a CAGR of 6.2% from 2025 to 2034. The market is witnessing a huge demand due to its potential to classify, identify, and quantify compounds for ensuring quality, food safety, and authenticity.

Ottawa, Nov. 04, 2025 (GLOBE NEWSWIRE) -- The global chromatography food testing market size was valued at USD 22.85 billion in 2024 and is predicted to grow from USD 24.27 billion in 2025 to reach nearly USD 41.70 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market growth is driven by increasing adoption of advanced HPLC and LC–MS technologies, rising regulatory pressure, and expanding use of automated, high-throughput testing systems in food laboratories worldwide.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5892

Key Highlights of the Chromatography Food Testing Market

- By region, North America led the chromatography food testing market with highest share of 35% in 2024.

- By region, Asia Pacific is projected to experience a significant CAGR of around 27% during the forecast period.

- By technique/technology, the high-performance liquid chromatography (HPLC) segment dominated the market with about 38% in 2024.

- By technique/technology, the ultra-performance liquid chromatography (UPLC) segment is expected to grow at the fastest CAGR of approximately 18% during the forecast period.

- By food type tested, the fruits & vegetables segment held the largest share of roughly 24% in 2024.

- By food type tested, the processed & packaged foods segment is anticipated to grow at a significant CAGR of around 16% during the forecast period.

- By end user, the food testing laboratories segment led the market with around 38% share in 2024.

- By end user, the food & beverage manufacturers segment is predicted to grow at the fastest CAGR of about 20% during the forecast period.

Overview of Chromatography in Food Testing

Chromatography is one of the most rigorous and evergreen analytical procedures in current laboratory science. At its main, chromatography is a procedure that classifies complicated mixtures into their particular components, which allows scientists to identify, purify, and quantify particular compounds. These classification procedures have updated everything from environmental testing to pharmaceutical development, which makes it an indispensable machine in current analytical laboratories.

| Application | Description | Technique |

| Protective analysis | To determine parabens and Formaldehyde agents |

HPLC |

| Heavy Metal Screening | Checking trace elements like as mercury and lead | ICP-MS + Chromatography |

| Fragrance Allergen Detection | Checking fragrance compounds that may cause irritation | GC-MS |

| Pigment and dye checking | Deciding integration of cosmetic colorants | HPLC |

Major Importers of the Chromatography Food Testing Market

- The Asia-Pacific region, which includes China and India, carries a majority share of the chromatography industry. This is because of fast industrialization and high funding in pharmaceutical research.

- India is the second-biggest importer at USD 304.1 million as India’s stretched healthcare and R&D sectors fulfill its urge for chromatography instruments. It has the imported value of USD 1.0 billion, as China is the biggest importer, which has developed biotechnology and pharmaceutical industries, which are the main drivers.

-

North America region: Developed global issues over food safety and environmental pollutants are driving the acceptance of chromatography to check toxins and contaminants. Organizations like the U.S Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) are required to use them for testing.

New Trends in the Chromatography Food Testing Market

- Miniaturization and Microfluidics: Miniaturization, specifically from the point of view of chromatography, is one of the most loyal trends for the future. The development in microfluidics enables the growth of cost-effective, portable, and quicker chromatographic systems. The growth of portable chromatographic machines, it is integrated with sensors, could change fields such as rapid diagnostics and field-based testing.

- Integration with Mass Spectrometry: Future growth in ionisation techniques and mass spectrometric instrumentation will enable the accurate checking of complicated compounds, even in trace levels, which stretches the scope of chromatography-based MS uses.

- UHPLC: By utilising the smaller pieces for stationary spaces, UHPLC mainly develops the speed and smoothness of classifications, which enables higher throughput tracking in environmental, pharmaceutical, and clinical uses.

- Green chromatography and sustainable practices: As sustainability becomes heavily crucial across scientific rules, green chromatography is developing as a main trend. Green chromatography concentrates on lowering the usage of hazardous solvents, which reduces the waste and increases the energy efficiency of the chromatographic systems. The growth of eco-friendly stationary phases, also alternative solvents like the supercritical CO2, bio-based, and C02 solvents will be on top to have more sustainable chromatographic methods.

- Automation and High-throughput systems: Automation in chromatography is developing rapidly, which allows high-throughput and continuous tracking. Robotic sample management, integrated data analysis that enables the fast processing of samples while lowering human error.

- Chromatography in Personalized Medicine: As personalized medicine continues to develop, chromatography will play a vital role in explaining particular patient profiles. Chromatographic procedures, integrated with huge spectrometry and genomic technologies.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/chromatography-food-testing-market

Recent Developments in Chromatography Food Testing Market

- In September 2025, Thermo Fisher Scientific revealed Chromleon 7.4, a chromatography and mass spectrometry (MS) data machine that is crafted to assist enterprise-level uses and regulatory compliance, as the organization revealed in a press release on 30th September 2025. (Source: https://www.chromatographyonline.com)

- In October 2025, Thermo Fisher Scientific revealed a latest high-resolution mass spectrometry system that is fully crafted particularly for environmental and food safety laboratories. The Orbitrap Exploris EFOX Mass Detector, which is short for Environmental and Food Organic Xenobotics, is constructed for pollutant tracking. (Source: https://www.chromatographyonline.com)

- In July 2025, at the 73rd American Society for Mass Spectrometry Conference on MS and Allied Topics in Baltimore, Maryland, Waters Corporation revealed many profile updates that focus on assisting developments in main uses and areas, which include per-and polyfluoroalkyl substances (PFAS) checking and biopharmaceutical tracking, among others. (Source: https://www.chromatographyonline.com)

Chromatography Food Testing Market Dynamics

Stringent Food Safety Standards and Technological Innovation Accelerate Market Growth

The chromatography food testing market is driven by the growing need for accurate detection of contaminants, additives, and residues to ensure food safety and quality. Rising incidences of foodborne illnesses and stringent regulatory standards from agencies such as the FDA and EFSA are fueling demand for advanced analytical techniques.

Additionally, increasing consumer awareness and preference for transparency in food labeling further boost the adoption of chromatography in food testing applications. Moreover, rapid technological advancements in chromatography instruments such as high-performance liquid chromatography (HPLC) and gas chromatography (GC) are enhancing testing efficiency and sensitivity, further propelling market growth.

Opportunity

Reverse Phase Chromatography Takes the Centre Stage

Reverse Phase Chromatography (RPC) procedure classifies compounds depending on their hydrophobicity (water-repelling character). Just like Normal Phase Chromatography, that have a polar stationary phase and a nonpolar mobile phase, it is a crucial machine in chemistry that is utilized to track the quality, safety, and authenticity of the food. It can check toxic chemicals, such as herbicides, pesticides, and synthetic dyes, in food products. This is crucial in order to protect users from unsafe ingredients.

As food fraud is a main issue, consultants can use checks to flavors in food items like coffee, wine, and dairy in order to make sure that each batch tastes the same.

It can even classify between synthetic and natural additives and even authenticate particular foods by checking their chemical patterns.

Challenge

Security and Quality are Main Issues in Chromatography Food Testing Industry

The role of food testing laboratories has never been more complicated. Quality and safety are the main issues for users, food producers, and governments. These groups experience a variety of problems, including a rising number of food pollutants, more rigid regulations, which protect the trade markets, which protect the brand image, and develop competition.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5892

Chromatography Food Testing Market Regional Analysis

North America dominated the Chromatography Food Testing Market in 2024

The North America region chromatography food testing market has developed as a complicated element in protecting public health and ensuring food safety standards across the region. With developing consumer awareness, rigid regulatory frameworks, and growing inconsistencies of food contamination and adulteration, the urge for high-level analytical techniques like chromatography has developed.

The market is classified by fast technological growth, which stretches uses in checking toxins, pesticides, and allergens, and a rising emphasis on quality assurance in the food supply chain. North America is at the top in the acceptance of chromatography-dependent food testing solutions. The current discovery in sector inventions and developing consumer demand for transparency further underlines the sector’s committed growth trajectory, which makes it an important area for strategic funding and technological development.

Asia Pacific is Predicted to be the Fastest-Growing Region in the Foreseeable Period

The urge for chromatography food testing in the Asia Pacific region is witnessing rapid development, which is being driven by the growing awareness, heavily strict food safety regulations, and the development of the international food trade. The industry is expected to rise mainly due to governments across the United States that are using and implementing stricter food safety standards. These compulsions are overall testing throughout the food supply chain, which develops the urge for high-level analytical procedures like chromatography, which focus on the quality, safety, and authenticity of their food. These moves purchasing behaviours and makes testing compulsory to gain user trust.

Europe is observed to have Notable Growth in the Foreseeable Period

The chromatography food testing industry in Europe is experiencing significant development, which is being driven by different factors like development in laboratory equipment, the developing demand for analytical testing across various industries, and the rising acceptance of chromatography procedures in terms of biotechnology, the environmental sector, and the pharmaceutical sector.

Chromatography is an important space utilised in sample containers in order to pack and protect pollutants during the analysis of complex mixtures. These mixtures are crafted to withstand heavy pressures and temperatures, which ensures that analytical outcomes are reliable and precise.

Chromatography Food Testing Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.2% |

| Market Size in 2025 | USD 24.27 Billion |

| Market Size in 2026 | USD 25.77 Billion |

| Market Size by 2034 | USD 41.70 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Chromatography Food Testing Market Segmental Analysis

Technology/Technique Analysis

The high-performance liquid Chromatography (HPLC) segment led the chromatography food testing market in 2024, as it has become a crucial aspect in terms of food safety testing. Due to its versatility, high sensitivity, and reproducibility, HPLC serves the accuracy that laboratories and products rely on to track additions and pollutants. It can even detect and quantify pesticides with very few pollutants, often down to parts per billion. It is combined with detectors such as mass spectrometry or UV, which enables laboratories to align with international standards.

Artificial sweeteners like saccharin, aspartame, and acesulfame potassium are prevalent in diet beverages, confectionery, and baked goods too. While checked for usage, their pollutant in completed products is strictly regulated to avoid overuse.

The ultra-performance liquid chromatography segment is predicted to grow fastest during the forecast period, as it is a technical procedure that provides good sensitivity in quantifying and qualifying elements in liquid samples. LC instruments classify a small mixture into its particular elements and components. A mainstay of analytical chemistry is completely invaluable while finding highly fragile data pertaining to even more mint particles, which is the level of the versatility and precision served, making liquid chromatography a developing series of applications and uses.

Food Type Tested Analysis

The fruits and vegetables segment dominated the chromatography food testing market in 2024, as pollutants like heavy metals, mycotoxins, and pathogens are an issue in food safety. These toxins can penetrate the food supply chain due to inaccurate storage, environmental factors, and improper handling, too. The big thing about chromatography is that it can check pollutants at even trace levels, which is particularly crucial due to several pollutant substances that may not have an obvious visual sign of pollution. Gas Chromatography-Mass Spectrometry is specifically useful in checking heavy metals or mycotoxins in terms of food, like aflatoxins in nuts and grains. This assists in protecting against long-term exposure to toxic substances, which could possibly lead to health problems like cancer or liver damage.

The processed and packaged foods segment is predicted to grow fastest during the forecast period. Chromatography classifies complicated food mixtures into elements, which makes it convenient to check and quantify toxic substances. It can check spoilage by counting the organic acids generated by bacteria, which identifies antibiotic residues in dairy and meat products, and search for the chemical pollutants from the production procedure.

Gas chromatography is utilised to check the important compounds that are responsible for materials, such as adhesives and plastics, which do not release toxic chemicals into the food. Producers use the chromatographic procedures in order to check that packaging materials, such as adhesives and plastics, will not release harmful chemicals into the food.

By End-Use Analysis

The food testing laboratories segment dominated the chromatography food testing market in 2024, as food testing labs are at the forefront of aligning these urges. These types of laboratories use high-level technologies and scientifically sound procedures to check and manage harmful pollutants in food products. By setting thorough tests, these labels assist in making sure that food products align with needed safety standards, which makes them perfect for consumption.

In order to maintain safety and public health, food purity testing labs depend on a variety of standard procedures and machines. These procedures are crafted to check even the minute traces of toxins, making sure that food products match global standards for quality and safety, too.

The food and beverage manufacturers segment is predicted to rise fastest during the forecast period. Volatile organic compounds (VOC) check the aromas and flavours of the food and drinks as we consume and are completely responsible for how the user receives the quality and freshness of the product. Management of VOCs is important in order to track product consistency by checking, refining, and manufacturing procedures that have an effect on the taste and smell of the product or whether a product has been tampered with.

The aromas and flavours of the food and drink are classified by the presence of important organic compounds they have. The classification in VOC profiles can have a big influence on user choice and can mainly affect the point of view of quality, freshness, and sensory experience.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Chromatography Food Testing Market and Their Strategic Impact

- Thermo Fisher Scientific offers a comprehensive range of chromatography instruments, including the Vanquish UHPLC and TRACE 1600 GC Series, supported by Chromeleon CDS software for seamless data management. The company continues to advance high-resolution Orbitrap mass spectrometry for ultra-trace contaminant detection, enabling laboratories to meet global regulatory standards with greater accuracy and automation.

- Agilent Technologies delivers trusted chromatography solutions such as the InfinityLab LC and 8890 GC systems, widely used for multi-residue and pesticide testing. By integrating cloud-based data management and AI-driven analytics, Agilent is transforming food testing into a more automated and digitally connected process that ensures precision and compliance.

- Shimadzu Corporation emphasizes sustainability and speed through its Nexera UHPLC and GCMS-QP2020 NX platforms. The integration of AI for peak identification and the use of low-solvent systems help laboratories improve throughput while supporting eco-friendly testing practices.

- Bruker Corporation specializes in advanced LC–MS and GC–MS solutions, including the timsTOF and scimaX HRMS systems, which enable detailed screening for food authenticity and complex contaminant profiling. The company continues to push the boundaries of non-targeted analysis in food safety.

- PerkinElmer Inc. (Revvity) provides reliable Flexar HPLC and Clarus GC systems tailored for rapid detection of contaminants and nutritional components. Through flexible pricing and scalable setups, the company empowers small and mid-sized laboratories to enhance testing capacity and meet evolving food safety requirements.

- JEOL Ltd. develops sophisticated GC–MS and NMR spectrometers used in molecular-level characterization and flavor analysis. Its collaborations with research institutions are expanding the scope of chromatography in academic and applied food science.

- Knauer Wissenschaftliche Geräte GmbH is known for its modular AZURA HPLC systems designed for flexibility, compliance, and ease of customization. These systems enable laboratories to adapt quickly to different testing applications while maintaining analytical reliability.

- Sykam GmbH manufactures ion chromatography and amino acid analyzers widely applied in food and agricultural testing. Its focus on affordability and user-friendly operation helps extend advanced analytical capabilities to smaller laboratories and regional testing centers.

- Hitachi High-Technologies Corporation integrates chromatography instruments with automation and data systems for high-volume testing of residues and additives. The company’s solutions enhance laboratory productivity and ensure consistency in routine food quality assessments.

- Merck KGaA (MilliporeSigma) provides chromatography consumables, reagents, and columns under its Supelco and LiChrospher brands, ensuring reproducibility across testing facilities. The company is also advancing sustainable chromatography through eco-conscious materials and manufacturing processes.

- Buchi Labortechnik AG specializes in sample preparation and evaporation systems that complement chromatography workflows by improving speed, accuracy, and solvent efficiency. Its technology supports laboratories pursuing green and efficient testing operations.

- SCIEX (Danaher Corporation) leads the field in LC–MS/MS and HRMS technologies with instruments such as the Triple Quad 7500 and ExionLC systems. These platforms deliver exceptional sensitivity and automation, setting new standards for detecting trace-level contaminants in complex food matrices.

-

Glison Inc. designs chromatography accessories and detectors that improve cross-platform compatibility and operational efficiency. Its solutions help laboratories reduce costs while maintaining high analytical performance across multi-brand testing setups.

Segments Covered in the Report

By Technique/Technology

- High-Performance Liquid Chromatography (HPLC)

- Gas Chromatography (GC)

- Ultra-Performance Liquid Chromatography (UPLC)

- Ion Chromatography (IC)

- Thin Layer Chromatography (TLC) & Others

By Food Type Tested

- Fruits & Vegetables

- Dairy & Dairy Products

- Meat & Poultry

- Processed & Packaged Foods

- Seafood & Aquaculture Products

- Beverages (Juice, Soft Drinks, Alcoholic)

- Grains & Cereals

By End User

- Food Testing Laboratories

- Contract Research Organizations (CROs) / Testing Services

- Food & Beverage Manufacturers

- Government & Regulatory Agencies

- Academic & Research Institutes

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5892

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.